LNG Shipping Outlook For 2018

Summary

- LNG shipping has seen a rough couple years lately.

- But 2017 could have been a pivot point.

- What does 2018 hold for this burgeoning segment?

Note: This article was originally published December 17th on Value Investor's Edge, a Seeking Alpha subscription service.

LNG Shipping

Maritime trade LNG (liquid natural gas) is a crucial link in the natural gas supply chain for many nations where domestic demand outstrips available supply. These vessels transport natural gas, which has been reduced to a liquid state by cooling it to minus 162°C, achieving a volume reduction of approximately 600 to one. Upon delivery, this LNG can be stored in a liquid state until the market demands, whereupon it enters a re-gasification process.

Companies that engage in LNG transport include, but are not limited to, Dynagas LNG Partners LP (NYSE:DLNG), Golar LNG Limited USA (NASDAQ:GLNG), Golar LNG Partners LP (NASDAQ:GMLP), GasLog Ltd. (NYSE:GLOG), GasLog Partners LP (NYSE:GLOP), Tsakos Energy Navigation Ltd. (NYSE:TNP), and Teekay LNG Partners L.P. (NYSE:TGP).

Overview

Available LNG vessel supply has quite possibly been the most influential factor in determining shipping rates recently. Over the past few years, spot rates have been on a wild ride plunging from 100k/day down to the 20k/day level as a massive influx of vessels outpaced demand. But demand for LNG vessels is picking up, and this has led to improving rates over the course of 2017 with spot charters now at 75k/day.

Here, we will take a look at the recent supply side growth rates, the current fleet, the orderbook, and potential demolition candidates. In addition, we will compare how this stacks up against demand growth predictions. This overview should give us a better understanding of what lies ahead in 2018.

Background

In a May 2016 article, I used the historical average of 6.6% CAGR from 2000 to 2014, using 2015 as a base, to determine the market could be at equilibrium in late 2020 to early 2021 using 46% demand side growth to account for the current 30% orderbook.

But, in my last LNG supply side article, we saw how increasing demand was able to absorb a very thick orderbook leading to rebalancing much sooner than anticipated. This forced me to revise 2017 demand forecasts from 6.6% upwards to 9%.

This turned out to be right on the money as discussed in a following article, LNG Shipping-An Improving Outlook. But in that same article, I also revised my forward projections upwards to 11% growth for 2017. Which again, according to recent data, appears to be credible.

So, where are we now and what exactly does 2018 and beyond hold?

Vessel Supply

As noted earlier the supply side has been a main culprit behind the recent turmoil. But orders for new vessels have remained relatively under control, and as newbuilds hit the water, we are witnessing a shrinking orderbook. This bodes well for the segment especially when coupled with robust demand.

Let's take a look at the current situation focusing specifically on vessels over 40,000 cubic meters (Cu. M.). Here, we will break it down by age in order to get a better grasp on potential demo candidates.

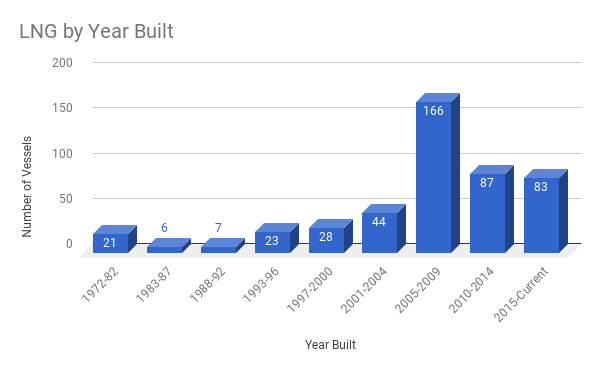

Source: Data from Clarksons Research, Chart by James Catlin

There are currently 465 LNG vessels above 40k Cu. M. trading on the water. The vast majority of those are relatively new, and therefore scrapping potential remains limited.

LNG vessels typically have a lifespan of about 40 years. The average age of demolitions since 2015 actually comes out to approximately 40 years, so we will use that as our indicator.

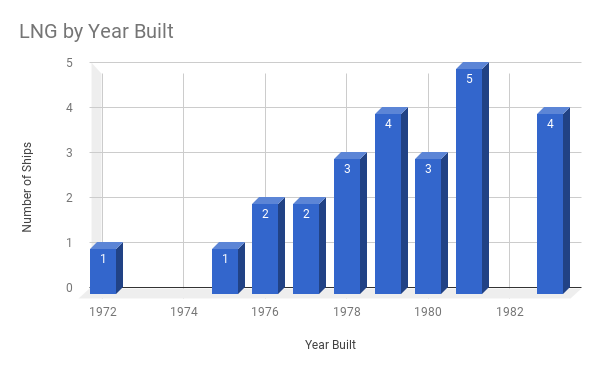

Source: Data from Clarksons Research, Chart by James Catlin

2018 will see 9 vessels on the water that are 40 years old and beyond. It might be a stretch to see all of those vessels sent to the scrapyard as 2016 and 2017 only saw two vessels retired each of those years. With rates gaining strength this means that minimal impact is expected from demolitions over the course of 2018.

This means scrapping won't be much help mitigating the large amount of supply projected to hit the water in 2018.

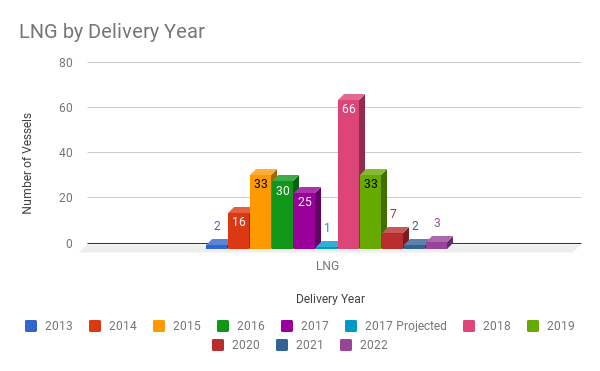

Source: Data from Clarksons Research, Chart by James Catlin

In fact, 2018 will see the heaviest amount of deliveries in several years.

By the end of 2017, we should have 466 vessels on the water. This means that the 66 deliveries expected in 2018 represent a 14% increase in the total fleet.

But LNG project construction delays could play a role in vessel slippage related to long term delivery contracts. In fact, An October 20th article, by Mike Corkhill of LNG World Shipping, reported that shipowners and shipyards have agreed to delay the scheduled delivery dates for 25 vessels representing approximately 20% of orderbook.

This means we could actually have net fleet growth closer to 9.5% if we experience approximately 33% slippage, which isn't out of the question, but could be a tad high. However, even at 20% slippage net fleet growth will still come out to just above 11%, which would be in line with my latest estimates of demand growth.

This means that if demand stays healthy, above 11% or so, we could see demand growth for LNG outpace vessel supply growth or at least remain in balance. But that doesn't account for one major factor, ton mile demand, which we will discuss in just a bit.

If we apply those 22 vessels (30% slippage) to 2019 and again account for slippage at about 20%, we see 41 net vessels delivered in 2019 against a fleet of 510 making representing just 8% fleet growth.

Once again given recent LNG demand this level of fleet growth is absolutely manageable. Of course, after 2019 deliveries fall off a cliff, and the market could comfortably absorb about 45 more orders in 2018 for delivery in 2020 without any negative impact going forward. Given that we only had 15 newbuild orders materialize throughout 2017 so far, a vessel shortfall in the next couple years becomes a possibility, even likely. This would send rates much higher.

LNG Supply

Just a few years ago, we seemed to solve the chicken/egg dilemma which plagued the LNG market. Supply wouldn't grow without demand, but without a stable, plentiful, and cheap supply demand infrastructure wouldn't see adequate investment. But a massive amount of LNG supply finally solved that dilemma paving the way for increasing adoption.

Australia took the lead with the USA not far behind. The initial build in supply has been unofficially termed Phase One. But now, Phase Two is gearing up, and as before this new supply could pave the way for greater adoption.

In the USA alone, the commencement of ~40Mtpa of new volumes by 2019 looks set to keep the market well supplied. This should keep prices relatively low and provide further incentive for adoption. But over the long run, there are currently 15 live proposals representing over 200Mtpa of potential supply. This sort of export capacity growth is the reason why many predict the USA will soon become the world's top LNG supplier. Of course, not all those will come to fruition, but a great deal will.

But we will also see other production increases, with the ramp-up of Chevron's (NYSE:CVX) Wheatstone and Gorgon projects in Western Australia, and the start-up of Ichthys LNG in Darwin. Wheatstone and Ichthys at full capacity will supply 8.9 million metric tonnes of LNG a year, and the bulk of that capacity is set to hit in the very near future.

Additionally, phase one of Yamal has come online late in 2017. The LNG Plant will be built in three phases, featuring a 5.5 Mtpa process train each, which are scheduled for start-up in 2017, 2018, and 2019.

Iran, home to the massive South Pars gas field is also looking to become an exporter. BMI reported that “Iran could export its first LNG by the end of 2018, following an agreement to deploy the Exmar-owned Caribbean FLNG at Pars Service Port on Kharg Island.”

One interesting development that is a bit further off than 2018 but still worth mentioning comes out of Africa. Three African floating LNG (FLNG) projects are inching forward in Cameroon, Equatorial Guinea, and Mozambique. Africa has several nations with ample natural gas reserves, and the success of these developments could inspire greater investment in the region.

Back to the near-term future. Even with the enormous amount of supply set to hit the market and talk of a LNG glut persists, Singapore-based Data Fusion rejects the glut scenario outright, forecasting only a "negligible" amount of oversupply will hit the global market in 2019, of about 5 million tonnes. They conclude that "the strength of the recovery in demand just isn't being appreciated and 2017 may have seen the last gasps of the glut scenario."

Demand

2017 is ending on a high note as spot demand to satisfy the seasonal peak has been robust, raising both charter rates and LNG landed prices in key markets.

My September 23rd article entitled LNG Shipping - An Improving Outlook detailed the significant demand side gains we have seen in 2017. So for a detailed picture on that front please refer to that article.

But let's touch briefly on a couple recent noteworthy items.

China has been a main driver behind the recent LNG demand surge and broke a record for LNG imports this past November.

LNG Shipping World reports:

Unconfirmed data indicates that Chinese LNG imports reached 4 mt in November 2017, a new monthly record which relegates the previous best of 3.7 mt in December 2016 to history. Chinese purchases for the entire 2017/18 winter season could top 20 mt.

China experienced a strong rally in LNG imports in 2016, with an impressive 36.9% growth totaling 27.42 mt. The first 11 months of the year saw China LNG imports at about 33.1 mt with another 4 mt expected for December bringing 2017's total to 37.1 mt representing about 35% growth over 2016.

This is significant since China may end up passing South Korea to take the number two spot among leading importers, a shift that analysts once projected to take place in 2019. This highlights the robust demand growth seen out of China and with only 55% of regasification capacity being utilized, there is still lots more room for growth. Over the course of the next year, three more terminals are set to commence operations representing another 10 Mtpa in regas capacity, and imports are expected to continue their impressive run.

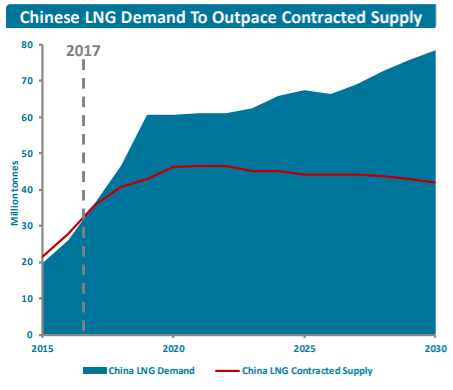

Source: Gaslog

In fact, next year, China's demand will likely exceed contracted supply forcing them to either sign new long-term contracts or turn to the spot market. Turning to the spot market won't be as easy as it once was just last year as contracted cargoes have increased significantly and vessel availability has dropped. More competition in the spot market will likely drive up rates.

But other nations are making contributions as well. BMI recently released a report detailing the impact of smaller and emerging markets regarding LNG demand. It states:

More than 20 gas-to-power projects will open new LNG markets using floating storage, creating more than 30M tonnes of new demand concentrated in emerging markets in 2016-2023.

Additionally, there are a few projects that are still up in the air, and if those come to fruition, the total from these emerging markets could top 40 mtpa.

Drewry estimates that Pakistan, Thailand, Bangladesh, the Philippines, and Myanmar will need approximately 25-30 additional LNG vessels to meet demand. But Ghana, Brazil, South Africa, Hong Kong, Myanmar, and Morocco have projects planned at similar scales, which will be completed in the short to medium term.

Emerging markets will be a key driver of growth going forward. Much of this will be made possible through Floating Storage and Regasification Units. More on that below.

Some rough math shows that the global LNG market readily absorbed around 30 mt of additional supply in 2017. There was 263.6 million tons of LNG traded in 2016. Therefore, I expect that total global demand for 2017 will have increased by 11.3% which is right on target with my latest forecast.

Now, at first glance, it looks like if 2018 can replicate 2017 in terms of demand, this would be in line with expected fleet growth creating a sort of flat year. But toward the end of the year, we have seen LNG demand growth come in closer to 13%, and there is no reason why this shouldn't continue. Therefore, I suspect demand growth alone will outpace fleet growth in 2018. But one additional factor should create quite a tailwind as well.

Ton Mile Demand

The LNG segment will be seeing robust gains in ton mile demand as more US LNG is imported by Europe, Asia, Africa and even South America. In fact, it is the segment which I see as benefiting the most from ton mile gains over the next two years.

Why is ton mile demand important? Because the longer a ship is out to sea for a given cargo, the longer it is removed from the supply side, thus reducing available supply and creating a tailwind for rates. In short, less supply given a constant demand will produce higher prices (charter rates).

As noted above, the USA will become a top exporter of LNG in the future. This meteoric rise will have a profound impact on trading patterns over the coming years and may be the most exciting shift seen in maritime trade since China's rapid ascension.

It's a bit speculative to begin calculating the expected impact of ton mile demand in 2018, but let's give it a shot.

First, we take into account the expected volume increases out of the USA based on increased liquefaction capacity. The initial growth in LNG exports was due to the ramp up of four 0.6-billion cubic feet per day (bcfd) liquefaction trains at Cheniere Energy Inc.’s (LNG) Sabine Pass LNG export facility in Louisiana. By the end of the year, another LNG export facility is expected to join Sabine Pass when Dominion Energy Inc.’s (NYSE:D) 0.7-bcfd Cove Point terminal in Maryland enters service. In 2018, three more U.S. liquification trains are expected to enter service - a 0.3-bcfd unit at Kinder Morgan Inc.’s (NYSE:KMI) Elba Island facility in Georgia, a 0.7-bcfd unit at Freeport LNG’s Freeport facility in Texas and a 0.6-bcfd unit at Cheniere’s Corpus Christi facility in Texas.

Traditional LNG voyages on average come in at about 4,000 miles. But cargoes out of the USA have been closer to 10,000 miles. Some rough math shows that this would lead to approximately 9% ton mile growth using very conservative liquification utilization and averaging the expected export volume throughout the year.

I thought that was pretty high so I decided to run it another way. The average number of laden days to deliver a cargo from suppliers other than the USA is about 12. A round trip, including loading, unloading, and the return would therefore come in at about 26, conservatively, not accounting for potential delays. DLNG showed in its recent investor presentation that the average number of laden days to deliver a cargo out of the USA is approximately 20.9 taking into account current destinations with weighting. So let's just say 21 and with loading, unloading, and the return trip that comes out to approximately 44 days.

Total nautical miles traveled in this scenario over the course of 2018, at 14.4 knots, would increase by approximately 8%. Now, if we factor in that Asia will most likely be absorbing the majority of these new cargoes with Latina America taking a back seat that ton mile growth be even higher likely in the 10% to 11% range.

Of course, this is just a rough picture of how the supply/demand dynamic will be altered once we look beyond the traditional fleet growth and expected demand increases. But it does show how 2018, which was seeing a balance between supply demand, will actually have a very favorable slant making the case for a more bullish 2018 as more days on the water will be required to deliver a given cargo.

It's also noteworthy that these estimates are in line with previous forecasts out of Drewry, which projected 9% ton mile growth in 2018 and 2019. But in that report, they severely underestimated global demand growth at just 5%. So, they bullish forecast they had for 2018 has undoubtedly strengthened.

What are FSRUs?

I seem to get this question every time I bring up FSRUs, so here is a brief overview. For those familiar with FSRUs, feel free to skip ahead to the next section.

Floating Storage and Regasification Units or FSRUs are vessels with the ability to turn LNG into its gaseous form. They are either purpose built or converted from old LNG carriers.

FSRUs present numerous advantages over land-based facilities. Consequently, this segment has seen significant growth from its inception in 2005. Currently, they are now the most popular regasification solution for new importers accounting for 75-85% of new LNG markets since 2007. They are playing a key role in making LNG imports far more accessible to markets.

Traditionally, the regas process was carried out on fixed land based facilities. However, Floating Storage and Regasification Units have started to gain popularity for several reasons:

Planning, permitting, and constructing a traditional, land-based LNG terminal typically requires five to seven years. In comparison, FSRU projects typically take around 24-36 months to execute.

FSRUs are considerably less capital-intensive than a land-based LNG terminal, where even small terminals can cost upwards of $600 million. Larger ones can exceed $1 billion.

A starving shipbuilding industry, the result of overcapacity and a lack of new orders, has been a main catalyst in a recent drop in vessel prices which include FSRUs. The latest FSRU ordered, a 173,400 cbm vessel, was listed at $230 million. Excelerate Energy has contracted Daewoo, S. Korea to build this particular vessel which is scheduled for delivery sometime between 2019 and 2020. But this order was important for another reason besides the price, since it came with an option for 7 additional vessels, highlighting Excelerate's bullish outlook for the space.

More importantly, the providers of FSRUs are prepared to retain ownership of their vessels and charter them to the importing company for a short, medium or long term period, avoiding the need for major capital outlays and corresponding financing requirements.

An importer has greater clarity on fees for regasification services and delivery of gas with an FSRU as compared to a land-based LNG terminal, which may be more likely to face construction cost overruns and uncertainty around terminal throughput fees.

Operational flexibility is significantly improved. FSRU operators have entered into agreements as short as three years, whereas land-based LNG terminals often require long term commitments of 15 years or more. This aspect has become increasingly important as new LNG importers are typically favoring shorter contracts with smaller volumes. In fact, since 2008, the average contract length has decreased by over 50% from about 18 years to around 7 years.

Finally, some FSRUs can also be operated as conventional LNG carriers and owners have been prepared to build such vessels on a speculative basis. This has made FSRU technology flexible in terms of being generic and able to meet different market needs and finding solutions to terminal location challenges.

Of course, as with almost everything, there are tradeoffs:

Land-based terminals typically have larger storage capacity and potentially larger gas send-out capacities than FSRUs, especially FSRUs that are a result of LNG carrier conversions.

Land-based facilities can offer improved expansion opportunities.

FSRUs can operate for about 20 years after building it, possibly more with the appropriate overhauling. However, onshore terminals are designed to last 25 years at least, and some have been operating for over 40 years now.

The boil-off rate of an FSRU is higher than that of a land based terminals, and boil-off gas that cannot be used for fuel or regas purposes has to be flared in the gas combustion unit.

The limitations on the physical size of an FSRU prevent it from having as much redundancy of vaporization equipment as a land-based terminal. As a result, an FSRU is more vulnerable to equipment outages, and thus requires the FSRU provider to hold very high standards regarding operations and maintenance.

Offshore Technology notes:

Whilst offshore regasification units boast smaller CAPEX, its higher OPEX may act as a drawback. An onshore unit will cost around $ 130,000 per day (4 MTPA), whilst an FSRU is likely to be around $280,000 per day (4 MTPA). The increased OPEX costs are largely due to the high leasing rate of an FSRU.

Finally, a technical problem with an FSRU could require a visit to drydock, which would result in a loss of service.

But don't think that it's as easy as pulling up a FSRU offshore and flipping a switch. Significant investment is still required to get that LNG to shore and onshore facilities are still required to get the gas to the market.

According to SSY senior LNG advisor Debbie Turner this additional connection and land based investment is hindering even more widespread adoption of LNG. She believes untapped demand is significant but “infrastructure, infrastructure, infrastructure” is the main obstacle. However, several ideas are in the development stage which will help small and mid-scale LNG importers to cut their costs and make adoption easier. This could make FSRU utilization easier, far more cost efficient, while needing less build time for required facilities.

Conclusion

I believe the LNG segment is likely the segment with the most promising forecast over the next couple years.

This accelerating demand side growth has been key component to a much earlier recovery in this market than previously anticipated, and looks to be sustainable going forward. In fact, it wouldn't surprise me to see 2018 LNG demand growth exceed that of 2017 as trade continues to accelerate at the end of this year. Could 13% growth be in the cards for 2018? It's very possible.

Vessel supply will still be a challenge in 2018, but if demand stays robust and we achieve a meaningful level of slippage, the market should improve. That improvement becomes all the more likely with increasing flows out of the USA adding to ton mile demand. That ton mile demand will likely be around the 9% range, but if Asia begins absorbing a majority of these new USA cargoes as opposed to Latin America, which took in much of the initial supply out of the USA, that ton mile growth figure could be in the double digits.

Currently, we are seeing some of the highest rates in a few years but this can be partially attributed to the seasonality of the trade, which should start to slow down a bit as winter in the northern hemisphere comes to an end.

While spot rates may slide a bit as a result, owners seeking long-term employment have much better prospects for higher rates on long-term charters as the market is showing some signs of life, and further tightening is expected throughout the end of the decade.

Overall, 2017 looks like the year we might have turned a corner, and 2018 will hopefully build on that momentum. But beyond 2018, the outlook grows even more promising as newbuilds hitting the water slow, but LNG supply and demand fundamentals remain strong. Additionally, as new cargoes continue to originate out of the USA, the average length of voyages will increase.

As usual, though, when a market has a promising forecast we must watch the orderbook to ensure that owners aren't getting carried away in an effort to capitalize on a potentially bullish cycle by placing more tonnage on the water. This collective action has been the undoing of more than one forecast, most recently, the crude tanker segment. Let's hope LNG owners can keep vessel supply in balance with potential demand going forward.

Thank you for reading, and I welcome all questions/comments.

If you would like to stay up to date on my latest analysis, I invite you to follow me on Seeking Alpha (click the "Follow" button next to my profile picture at the top) as I continue to cover all aspects of maritime trade.

Value Investor's Edge

Value Investor's Edge is a top-rated Seeking Alpha research service, which focuses primarily on the volatile, and therefore potentially very profitable, shipping industry. Members receive a two-week lead time on all reports by James Catlin, alongside exclusive content by J. Mintzmyer, a top-tier deep value analyst. This platform offers actionable trades and strategic income opportunities through Mr. Catlin's data-driven macro analysis, which often complements Mr. Mintzmyer's company-specific analysis. This winning team has developed a dedicated following of highly knowledgeable investors and industry professionals who also share their own thoughts and ideas on Value Investor's Edge.

Disclosure: I am/we are long GLOP, TGP, GLNG.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Link : https://seekingalpha.com/amp/article/4134276-lng-shipping-outlook-2018

Comments

Post a Comment